According to the sales results, June numbers suggest we might be seeing the first signs of a market finding its footing after months of uncertainty. While sales were still down 9.8% compared to June 2024, the decline has notably improved from May's steeper drop. Although we had a very busy May, sales overall were still down 20% so now at 9.8% we are seeing a significant improvement. As Andrew Lis from Greater Vancouver Realtors (GVR) observes, there are emerging signs that sales activity is beginning to stabilize. It's not a rebound yet, but we can remain hopeful. We are still down over 25% from the 10-year average in terms of sales AND there are 43.7% more listings than the 10-year average (again screaming "buyers' market") but a monthly sales volume down under 10% from the previous year is much better than the 20% below we saw in May. So a decent improvement in sales volume.

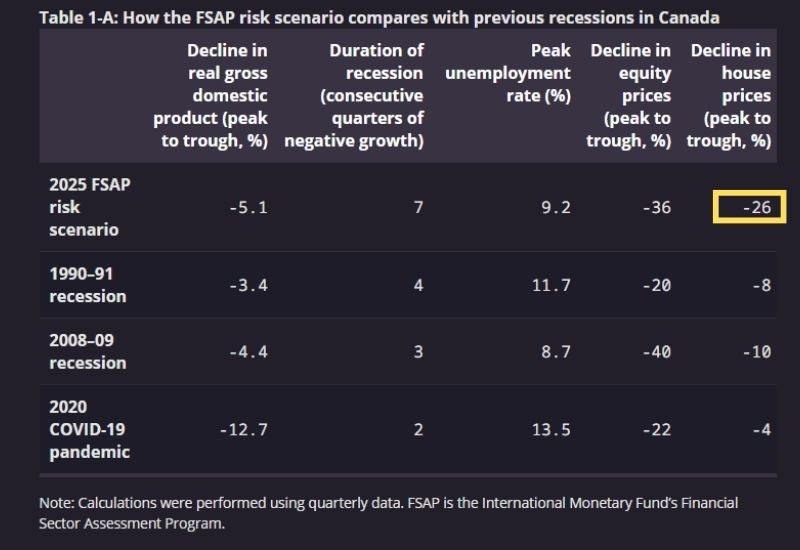

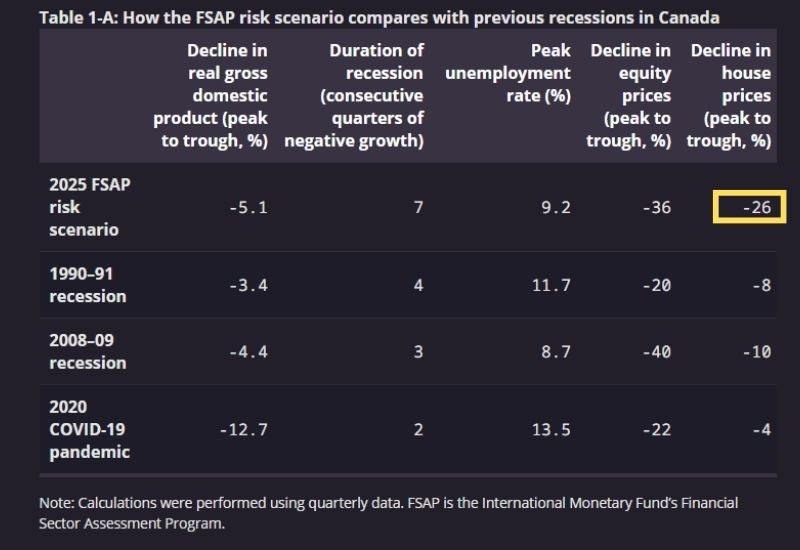

Having said that, others are predicting that the entire country (particularly Vancouver and Toronto) could see further, significant drops not only in sales volumes, but also in prices. The Bank of Canada released a "disturbing" (to me at least) chart last month comparing the potential impact of tariffs on our real estate market to the past significant market declines that we have experienced. I find it hard to believe that we could see drop like those noted in the chart BUT in the USA in 2008 we did see drops in prices of 50% so I suppose this is not impossible:

Getting back to the much more optimistic projections of the GVR Chief Economist, and the numbers from last month, there has been a shift in inventory and demand. Active listings remain high as I mentioned at 17,561—a significant 43.7% above the 10-year average—but the rate of new listings entering the market is slowing. This means buyers still have plenty of options, but the overwhelming flood of inventory we saw earlier this year is starting to taper off. Combine this with mortgage rates that have dropped nearly 2% since last summer, and we continue to see a scenario where buyers suddenly find themselves with more leverage and breathing room than they've had in years. For now....

Prices, while still down year-over-year, are showing early signs of stabilization. Detached homes, condos, and townhomes all saw prices dip around 3% compared to last June, but the month-to-month declines are shrinking—some as small as 0.1% to 0.3%. We still have a lot of situations where sellers are not accepting what buyers are prepared to pay so we continue to wonder if the 3% number is accurate given the number of offers NOT being accepted by sellers.

The big question now is whether this is the bottom. Some buyers are still waiting to see-potentially a very risky thing to do. The sales-to-active listings ratio sits at 12.8%, which traditionally indicates a balanced market. However, detached homes, with a ratio of just 9.9%, are in buyer's market territory. History tells us that sustained ratios below 12% put downward pressure on prices, while ratios above 20% drive prices up. We're not there yet, but if sales continue to improve, we could move back into a more seller favourable market.

If we look at the June 2025 numbers, last month in Greater Vancouver we saw:

Having said that, others are predicting that the entire country (particularly Vancouver and Toronto) could see further, significant drops not only in sales volumes, but also in prices. The Bank of Canada released a "disturbing" (to me at least) chart last month comparing the potential impact of tariffs on our real estate market to the past significant market declines that we have experienced. I find it hard to believe that we could see drop like those noted in the chart BUT in the USA in 2008 we did see drops in prices of 50% so I suppose this is not impossible:

Getting back to the much more optimistic projections of the GVR Chief Economist, and the numbers from last month, there has been a shift in inventory and demand. Active listings remain high as I mentioned at 17,561—a significant 43.7% above the 10-year average—but the rate of new listings entering the market is slowing. This means buyers still have plenty of options, but the overwhelming flood of inventory we saw earlier this year is starting to taper off. Combine this with mortgage rates that have dropped nearly 2% since last summer, and we continue to see a scenario where buyers suddenly find themselves with more leverage and breathing room than they've had in years. For now....

Prices, while still down year-over-year, are showing early signs of stabilization. Detached homes, condos, and townhomes all saw prices dip around 3% compared to last June, but the month-to-month declines are shrinking—some as small as 0.1% to 0.3%. We still have a lot of situations where sellers are not accepting what buyers are prepared to pay so we continue to wonder if the 3% number is accurate given the number of offers NOT being accepted by sellers.

The big question now is whether this is the bottom. Some buyers are still waiting to see-potentially a very risky thing to do. The sales-to-active listings ratio sits at 12.8%, which traditionally indicates a balanced market. However, detached homes, with a ratio of just 9.9%, are in buyer's market territory. History tells us that sustained ratios below 12% put downward pressure on prices, while ratios above 20% drive prices up. We're not there yet, but if sales continue to improve, we could move back into a more seller favourable market.

If we look at the June 2025 numbers, last month in Greater Vancouver we saw:

• sales of all types of properties were DOWN 9.8% from June 2024

• sales were 25.8% BELOW the 10-year seasonal average (2,940)

• the number of homes listed for sale last month was 17,561 which is UP 23.8% when compared with June 2024. This is 43.7% higher than the 10-year average (12,223)

• the number of homes newly listed for sale was UP 10.3% from June 2024 and 12.7% OVER the 10-year average (5,604)

• detached home sales were DOWN 5.3% from June 2024

• the benchmark price for detached homes was DOWN 3.2% when compared to June 2024; and a 0.1% decrease compared to May 2025

• the sales to listing ratio overall for all types of homes was 12.8%; for detached homes the ratio is 9.9%. Prices trend downward when the ratio is around 12%

• sales were 25.8% BELOW the 10-year seasonal average (2,940)

• the number of homes listed for sale last month was 17,561 which is UP 23.8% when compared with June 2024. This is 43.7% higher than the 10-year average (12,223)

• the number of homes newly listed for sale was UP 10.3% from June 2024 and 12.7% OVER the 10-year average (5,604)

• detached home sales were DOWN 5.3% from June 2024

• the benchmark price for detached homes was DOWN 3.2% when compared to June 2024; and a 0.1% decrease compared to May 2025

• the sales to listing ratio overall for all types of homes was 12.8%; for detached homes the ratio is 9.9%. Prices trend downward when the ratio is around 12%

So what does this mean for you? For buyers, you still have a window of opportunity—one where favorable rates, ample inventory, and motivated sellers align. But markets rarely stay in this sweet spot for long-especially in the Lower Mainland. For sellers, the message is more nuanced. Prices haven't rebounded yet, but with demand showing signs of life, hopefully it will become a lot easier to sell, as long as there are not a wave of new listings come fall.

The next 60 days could be telling. We are in the summer market-which is not usually a great time to sell BUT if buyers are now getting off the fence, this could be an unusual summer for real estate. If current trends hold, we could be looking at a market that's not just stabilizing but quietly regaining momentum. We will see!

The next 60 days could be telling. We are in the summer market-which is not usually a great time to sell BUT if buyers are now getting off the fence, this could be an unusual summer for real estate. If current trends hold, we could be looking at a market that's not just stabilizing but quietly regaining momentum. We will see!